crypto coins gif Explore the Fusion of Animation and Currency

Crypto coins gif sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. In the rapidly evolving digital economy, cryptocurrency stands at the forefront, reshaping how we think about money and transactions. With numerous crypto coins like Bitcoin, Ethereum, and others, each boasting unique features, understanding their significance is crucial.

Coupled with this is the rise of GIFs, which have become a powerful tool in marketing and communication, particularly in the crypto space.

Understanding Crypto Coins

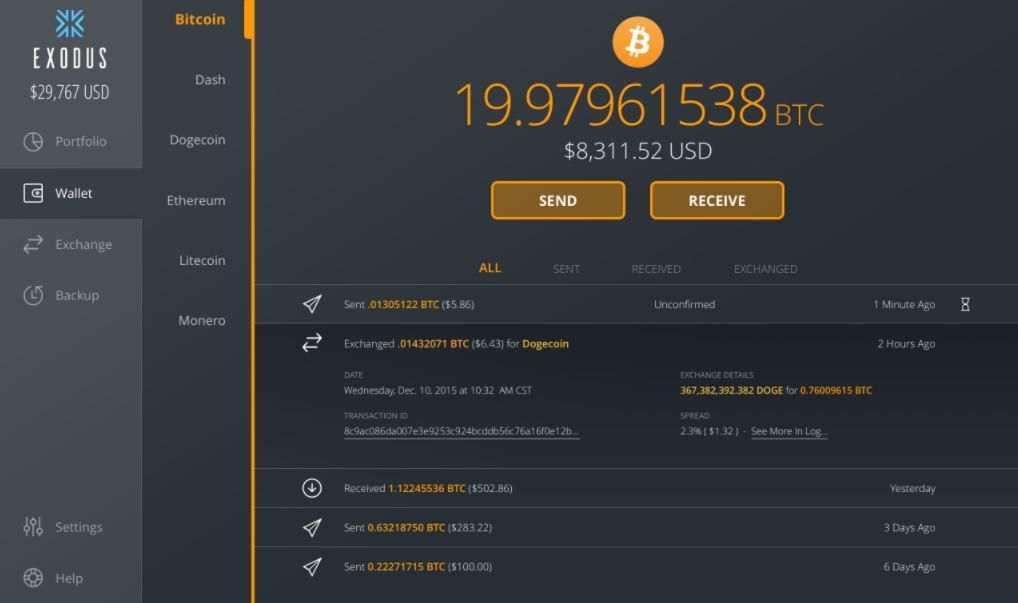

Cryptocurrencies have emerged as a revolutionary form of digital currency that fundamentally alters how we perceive and engage with money. With their decentralized nature and reliance on blockchain technology, crypto coins play a significant role in the digital economy, offering both investment opportunities and innovative solutions for transactions.To grasp the essence of crypto coins, it is essential to familiarize oneself with some of the most popular ones in the market.

Here's a detailed list highlighting their unique features:

- Bitcoin (BTC): The first and most well-known cryptocurrency, serving as a digital gold and a store of value.

- Ethereum (ETH): A platform enabling smart contracts and decentralized applications (dApps), fostering innovation in various sectors.

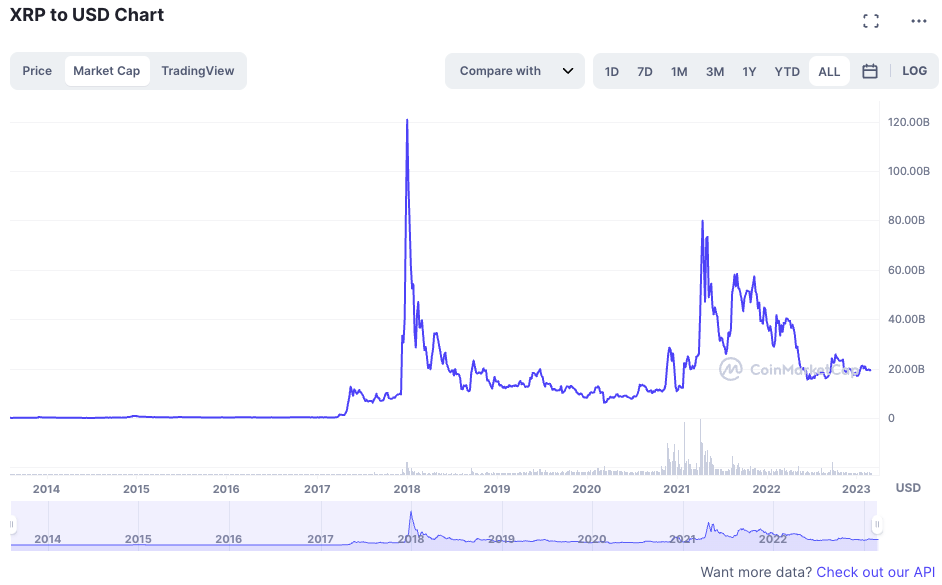

- Ripple (XRP): Focused on facilitating cross-border payments, it offers fast transaction times and low fees.

- Litecoin (LTC): Designed as the “silver” to Bitcoin's gold, it offers quicker transaction confirmations.

- Cardano (ADA): A blockchain platform emphasizing sustainability and scalability, incorporating a research-driven approach.

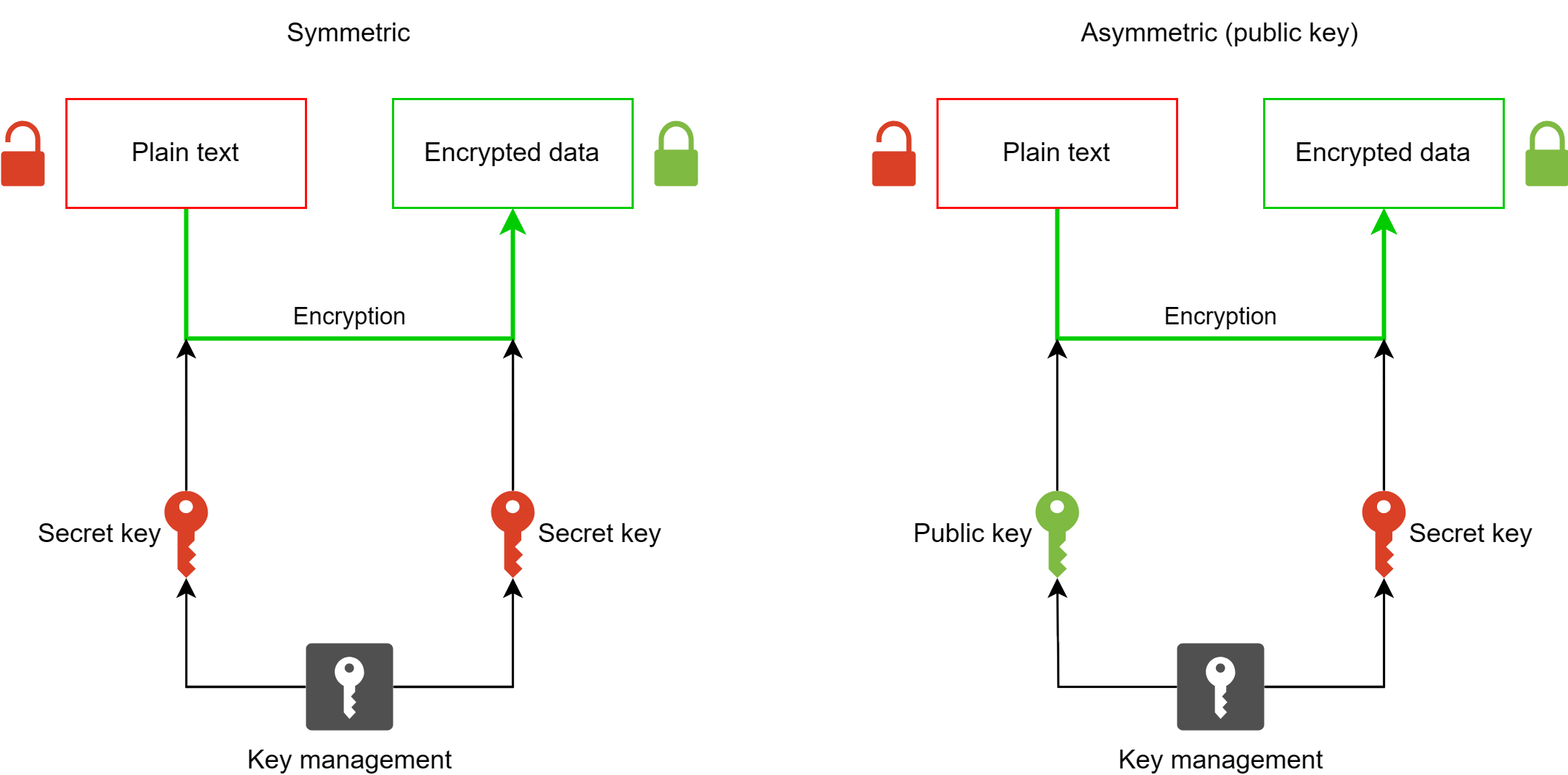

The technology behind these coins primarily involves blockchain and cryptography. Blockchain is a decentralized ledger that records all transactions across a network of computers, ensuring transparency and security. Cryptography secures these transactions, protecting user data and preventing fraud.

The Role of GIFs in Cryptocurrency

GIFs have become an integral part of modern digital communication, and their role in promoting crypto coins cannot be overlooked. These animated visuals are highly engaging and can simplify complex concepts, making them ideal for marketing purposes in the cryptocurrency sector.The benefits of using GIFs in social media marketing for cryptocurrency include:

- Increased Engagement: GIFs capture attention and encourage shares, boosting visibility.

- Brand Recognition: Well-designed GIFs enhance brand recall and create a memorable image.

- Information Simplification: GIFs can break down complicated topics into digestible snippets.

Successful crypto-related GIF campaigns have included promotions for new coin launches, educational content explaining blockchain technology, and community-building initiatives that resonate with users.

Creating Crypto Coins GIFs

Designing an animated GIF for a crypto coin involves several key steps. First, conceptualize the message and target audience. Next, gather relevant visuals and text that resonate with the crypto community. After that, it's time to create the animation, ensuring it's engaging and informative.To assist in the creation of crypto coins GIFs, several tools and software options can be utilized:

- Adobe Photoshop: A professional tool for creating high-quality GIFs with advanced editing features.

- Giphy’s GIF Maker: An easy-to-use online tool for quick GIF creation.

- Canva: Offers templates and intuitive design features, perfect for beginners.

When creating GIFs in the crypto space, best practices should include:

- Keep It Simple: Avoid overcrowding the GIF with too much information.

- Focus on Branding: Ensure your brand logo and colors are prominently displayed.

- Test for Engagement: Share drafts within your community to gather feedback before launching.

The Impact of GIFs on Crypto Communities

GIFs significantly enhance community engagement among crypto enthusiasts, providing a fun and interactive way to connect. They can also serve educational purposes, helping users understand intricate topics such as blockchain mechanics or investment strategies.User-generated GIFs have gained popularity in the crypto world, showcasing creativity and community spirit. Examples include:

- Fan-made animations of crypto memes that resonate with the community.

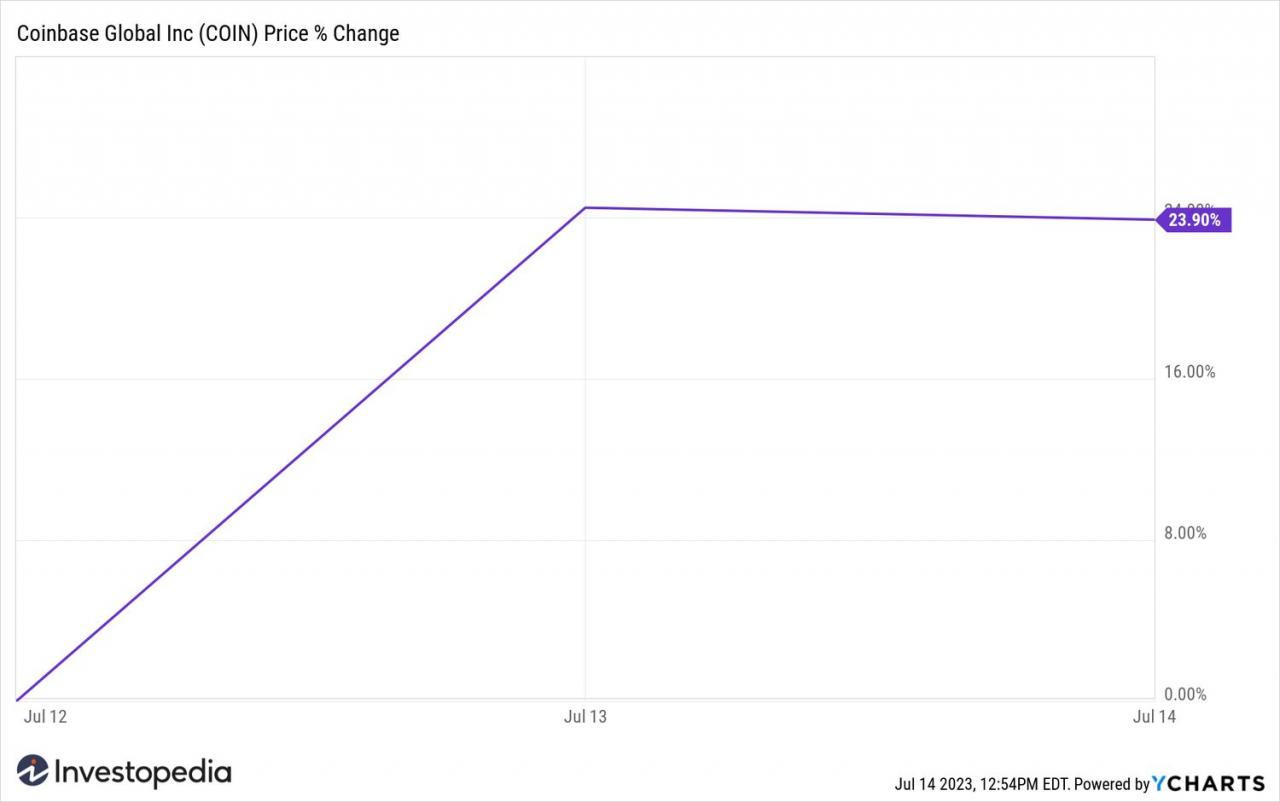

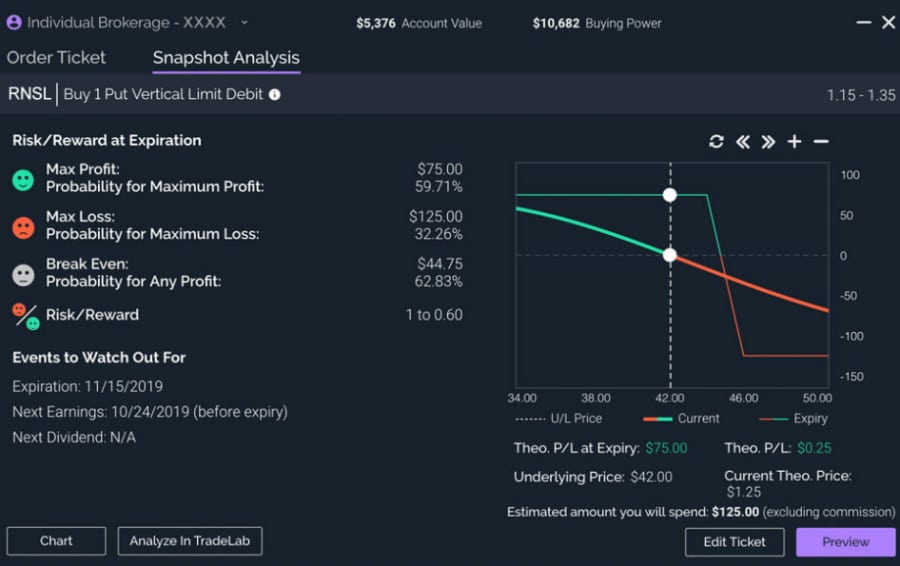

- GIFs illustrating market trends and coin performance updates.

These community-driven creations foster a sense of belonging and encourage discussions around various cryptocurrencies.

Future Trends in Crypto Coins and GIFs

As the cryptocurrency landscape evolves, so too will the use of GIFs in marketing. Future trends may see the incorporation of augmented reality and 3D animations that offer immersive experiences for users, facilitating deeper connections.Emerging technologies such as AI and machine learning could influence the creation and sharing of GIFs, allowing for personalized content tailored to individual user preferences. Potential new use cases for GIFs in promoting upcoming crypto coins may include:

- Interactive Features: GIFs that respond to user actions, creating an engaging marketing experience.

- Real-Time Data Visualizations: GIFs that showcase live market data, making information more accessible and dynamic.

Closing Notes

In conclusion, the intersection of crypto coins and GIFs represents a dynamic landscape that is constantly evolving. As we anticipate future trends, it's clear that GIFs will play an even more pivotal role in enhancing community engagement and promoting cryptocurrencies. The creative possibilities are endless, making it an exciting time to explore how animated visuals can amplify the message of the crypto world.

FAQ Guide

What are crypto coins GIFs?

Crypto coins GIFs are animated images that represent various cryptocurrencies, often used for promotional or educational purposes.

How can GIFs benefit cryptocurrency marketing?

GIFs can attract attention, simplify complex concepts, and enhance engagement on social media platforms, making them an effective marketing tool.

What tools can I use to create crypto coins GIFs?

Popular tools for creating GIFs include Adobe Photoshop, Giphy, and Canva, which offer user-friendly interfaces for designing animated graphics.

Can GIFs be used for educational purposes in crypto?

Yes, GIFs can simplify and illustrate complex topics, making them useful for educating crypto enthusiasts about various concepts and technologies.

What trends can we expect for GIFs in the crypto space?

We can expect GIFs to become more interactive and integrated with emerging technologies, enhancing their use in marketing and community engagement.

.jpg)