Xrp Coins Circulation An In-depth Exploration

XRP coins circulation sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail. The circulation of XRP coins plays a crucial role in the broader cryptocurrency market, influencing everything from liquidity to investor confidence. As we delve into this topic, we will explore how XRP is distributed, the factors that impact its supply, and the strategies employed to manage its circulation effectively.

Understanding XRP’s circulation is essential for grasping its significance among cryptocurrencies. With a unique supply model and active management by Ripple, XRP’s circulation presents a fascinating study of economic principles and market dynamics. We’ll also look at the role of community engagement and technological advancements in shaping the future of XRP’s circulation.

Overview of XRP Coin Circulation

XRP is one of the prominent cryptocurrencies that plays a vital role in the digital economy. Understanding the concept of coin circulation is essential for grasping its impact on market dynamics. Coin circulation refers to the amount of a cryptocurrency that is actively available in the market for trading and use, which influences its price and overall adoption.XRP coins are distributed within the market through several mechanisms, primarily managed by its parent company, Ripple.

The total supply of XRP is capped at 100 billion coins, with a significant portion pre-mined and held in reserve by Ripple Labs. Currently, the circulating supply of XRP stands at around 50 billion coins, actively traded on various exchanges worldwide.

Factors Influencing XRP Coin Circulation

Several key factors influence the circulation of XRP coins, impacting its demand and pricing. These factors include:

- Market Demand: The demand for XRP is significantly influenced by its use as a bridge currency in cross-border transactions, which can drive up its circulation.

- Economic Indicators: Fluctuations in global economic indicators such as inflation rates, interest rates, and GDP growth can affect investor sentiment towards XRP.

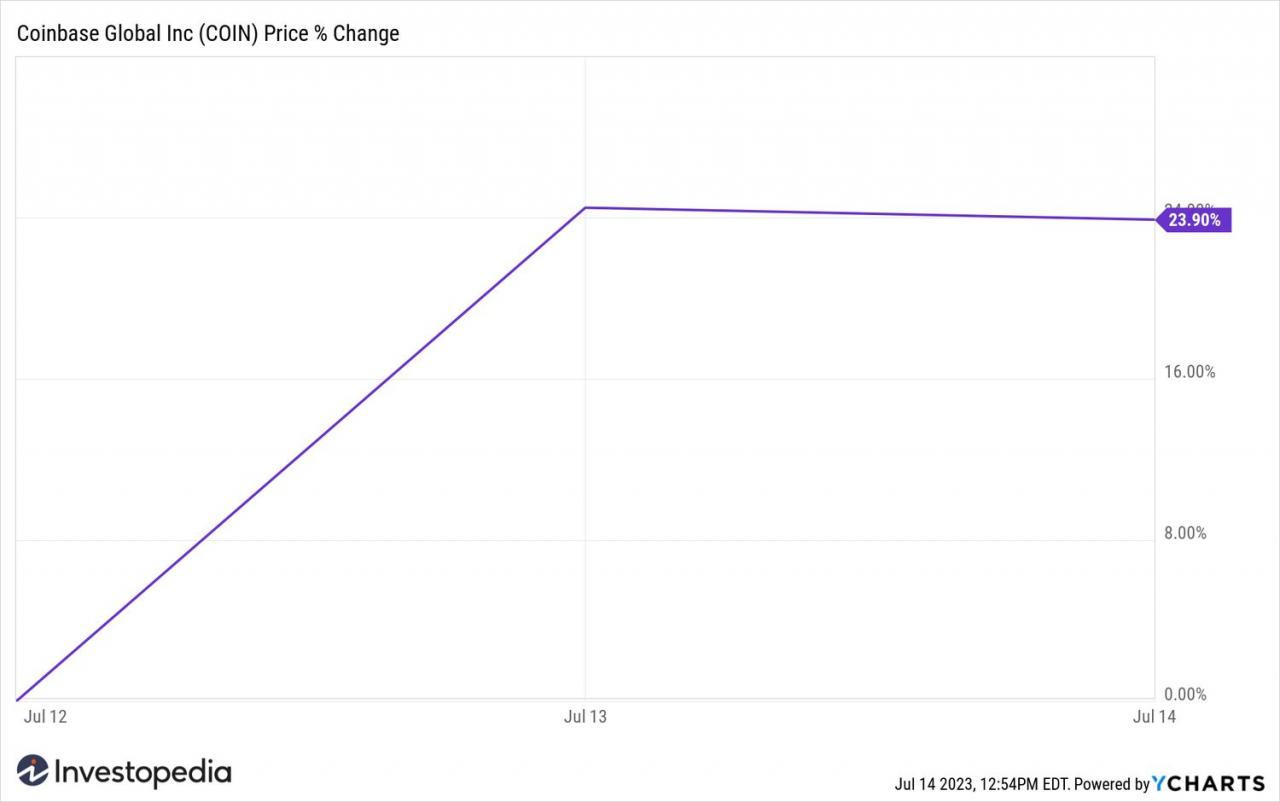

- Regulatory Environment: Changes in regulations regarding cryptocurrencies can either encourage or hinder the circulation of XRP. Favorable regulations can lead to increased adoption, while stringent laws may restrict its use.

The Role of XRP in the Cryptocurrency Market

XRP holds a unique position in comparison to other cryptocurrencies like Bitcoin and Ethereum. While Bitcoin is primarily seen as a store of value and Ethereum serves as a platform for decentralized applications, XRP is focused on enhancing the efficiency of cross-border payments.

| Cryptocurrency | Total Supply | Circulating Supply | Market Cap (Approx.) |

|---|---|---|---|

| XRP | 100 Billion | 50 Billion | $25 Billion |

| Bitcoin | 21 Million | 19 Million | $500 Billion |

| Ethereum | Unlimited (with inflation) | 120 Million | $220 Billion |

The implications of XRP’s circulation on liquidity and market stability are substantial. A higher circulating supply generally leads to greater liquidity, allowing for smoother transactions and less volatility in the market.

XRP Coin Circulation Strategies

Ripple employs various strategies to manage the circulation of XRP coins effectively. One of the primary methods is the controlled release of coins from its escrow account, which ensures a steady supply while preventing sudden market dumps.Additionally, Ripple has considered token burn mechanisms as a means to reduce supply over time. This approach not only aims to stabilize the price but also enhances the long-term value of XRP.

Partnerships with financial institutions further bolster XRP’s circulation by integrating it into real-world financial systems, increasing its utility and demand.

Future Projections for XRP Coin Circulation

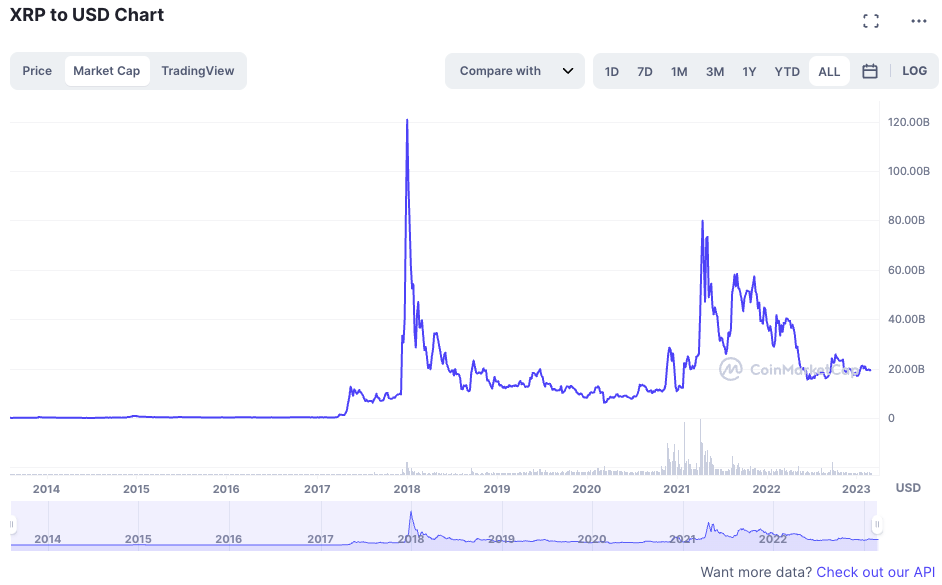

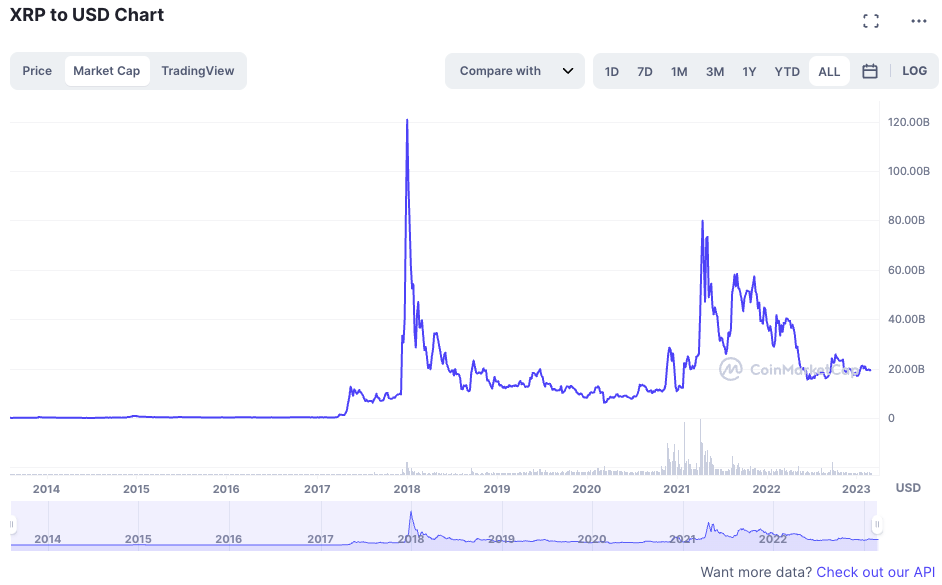

Future trends suggest that the circulation of XRP coins may experience significant changes due to evolving market dynamics and technological advancements. As more financial institutions adopt blockchain technology, the demand for XRP as a bridge currency is likely to grow.Potential scenarios include increased regulatory clarity, which could lead to broader acceptance of cryptocurrencies. As seen with Bitcoin’s and Ethereum’s market trajectories, XRP could see a substantial rise in its market presence within the next five years if it successfully navigates regulatory landscapes and market competition.Technological advancements such as improved transaction speeds and cost-effectiveness can also enhance XRP’s circulation dynamics, driving further adoption among users and institutions alike.

Community and Ecosystem Impact on XRP Circulation

Community engagement plays a crucial role in influencing XRP’s circulation. A vibrant community can advocate for the use of XRP in various sectors, enhancing its visibility and utility.Some notable use cases for XRP include:

- Cross-border Remittances: As a bridge currency for transferring value quickly and cost-effectively between different currencies.

- Payment Settlements: Used by financial institutions for real-time settlement of transactions, reducing the need for traditional banking hours.

- Smart Contracts: Integration into platforms that utilize XRP for executing decentralized contracts efficiently.

Developers and projects working within the XRP ecosystem are vital in enhancing its functionality and promoting its use. Their innovations can lead to increased adoption, ultimately affecting the circulation of XRP coins in the market.

Ending Remarks

In conclusion, the circulation of XRP coins is more than just numbers; it reflects the complex interplay of market forces, regulatory environments, and community involvement. As XRP continues to evolve, its strategies for circulation will be crucial in defining its market position and sustaining investor interest. Whether you’re a seasoned investor or a newcomer to the cryptocurrency world, understanding these dynamics will equip you with the knowledge to navigate the ever-changing landscape of digital currencies.

Clarifying Questions

What is the total supply of XRP coins?

The total supply of XRP coins is capped at 100 billion.

How does XRP’s circulation compare to Bitcoin and Ethereum?

XRP has a different distribution model, leading to a higher percentage of coins in circulation compared to Bitcoin and Ethereum.

What factors can influence the demand for XRP coins?

Key factors include market trends, regulatory news, and technological developments within the Ripple ecosystem.

How does Ripple manage XRP’s circulation?

Ripple employs various strategies such as escrow accounts and token burns to regulate the supply of XRP.

What role does the community play in XRP’s circulation?

The community impacts XRP’s circulation through engagement, use cases, and support for projects that utilize XRP.